Sales tax compliance is a critical aspect of running a business, regardless of its size or industry. Failing to comply with sales tax regulations can result in penalties, audits, and reputational damage. To ensure airtight sales tax compliance, businesses need to implement best practices and leverage the right tools. In this article, we will explore the importance of sales tax compliance, discuss best practices for achieving compliance, and highlight some useful tools to streamline the process.

The Importance of Sales Tax Compliance

Legal Requirements and Consequences of Non-Compliance

Sales tax compliance is not optional—it is a legal obligation for businesses selling taxable goods or services. Failure to comply with sales tax regulations can lead to severe consequences, including fines, penalties, interest charges, and even legal action. Non-compliance can also damage a business’s reputation and erode customer trust.

Evolving Sales Tax Regulations

Sales tax regulations are complex and ever-changing. Each state and jurisdiction has its own set of rules and rates, making compliance a challenging task for businesses operating across multiple locations. Furthermore, new legislation and court rulings can impact sales tax requirements, making it crucial for businesses to stay up to date with the latest changes to ensure compliance.

Customer Expectations and Competitive Advantage

In addition to legal obligations, sales tax compliance is essential for maintaining positive customer relationships. Customers expect businesses to accurately calculate and collect sales tax, and failure to do so can lead to customer dissatisfaction. Furthermore, businesses that demonstrate a commitment to compliance can gain a competitive advantage by building trust and credibility with their customers.

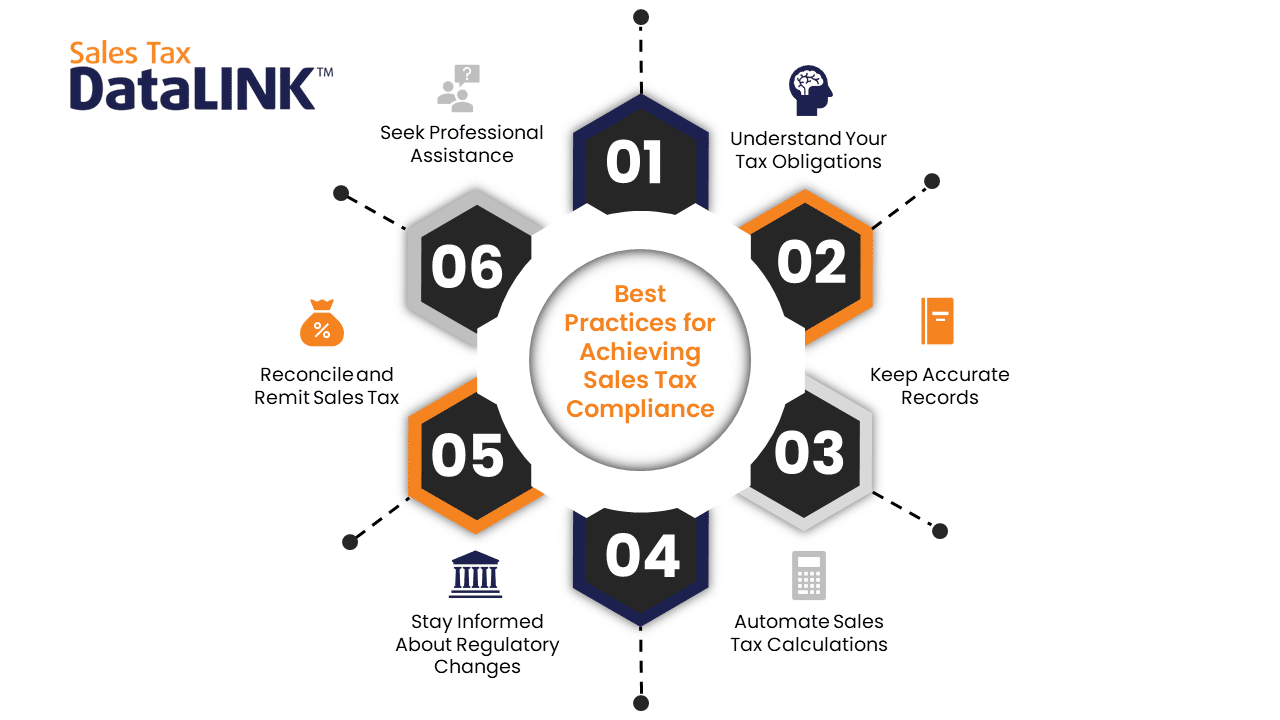

Best Practices for Achieving Sales Tax Compliance

1. Understand Your Sales Tax Obligations

The first step in achieving sales tax compliance is to understand your obligations. This includes determining which jurisdictions you have nexus (a significant presence that triggers sales tax obligations), identifying taxable products or services, and understanding the applicable sales tax rates.

2. Keep Accurate Records

Maintaining accurate and organized records is crucial for sales tax compliance. This includes documentation of sales transactions, exemption certificates, and any other relevant information. Accurate records not only facilitate compliance but also provide valuable evidence in the event of an audit.

3. Automate Sales Tax Calculations

Manual sales tax calculations are prone to errors and can be time-consuming, especially for businesses with a high volume of transactions. Automating sales tax calculations using dedicated software or integrating sales tax calculation capabilities into your e-commerce platform can help streamline the process and ensure accuracy.

4. Stay Informed About Regulatory Changes

Sales tax regulations are subject to frequent changes, so it’s essential to stay informed about updates that may affect your business. Subscribe to industry newsletters, follow relevant tax authorities’ announcements, and consider consulting with a tax professional to ensure you stay ahead of any new requirements.

5. Regularly Reconcile and Remit Sales Tax

Reconciling and remitting sales tax regularly is crucial for compliance. Set a schedule to review your sales tax records, reconcile them with your financial statements, and remit the collected tax to the appropriate tax authorities within the specified deadlines.

6. Invest In Staff Training or Seek Professional Assistance

Sales tax compliance can be complex, especially for businesses with limited resources or expertise. Consider investing in staff training to ensure your employees understand their responsibilities and the latest compliance requirements. Alternatively, seek assistance from tax professionals or consultants who specialize in sales tax compliance.

Tools for Streamlining Sales Tax Compliance

Sales Tax Software

Sales tax software automates the calculation, collection, and reporting of sales tax. These tools integrate with e-commerce platforms, point-of-sale systems, and accounting software to streamline the entire sales tax compliance process.

E-Commerce Platform Integrations

If you run an online business, consider choosing an e-commerce platform that offers built-in sales tax integrations. Platforms like Epicor, WooCommerce, and BigCommerce provide integrations with sales tax software or built-in tax calculation capabilities, simplifying compliance for online sellers.

Tax Rate Lookup Tools

Tax rate lookup tools help businesses determine the correct sales tax rate for each transaction. These tools typically provide up-to-date information on state, local, and special district tax rates based on the customer’s location.

Accounting Software with Sales Tax Capabilities

Numerous accounting software solutions available in the market come equipped with built-in sales tax functionalities. These platforms enable businesses to automate the calculation of sales tax, produce sales tax reports, and streamline the reconciliation process by incorporating sales tax information directly into their financial records. This integration of sales tax management within the accounting software simplifies the entire process, making it more efficient and less prone to errors.

How We Can Help

Sales tax compliance is a complex yet essential aspect of running a business. It demands a thorough understanding of state and local regulations, meticulous record-keeping, and accurate tax calculations. However, manual compliance processes can be time-consuming and error-prone, particularly for businesses operating across multiple tax jurisdictions.

Luckily, technological advancements have led to the development of tools that can significantly streamline the sales tax compliance process. Among these tools is Sales Tax DataLINK, our comprehensive solution that automates a multitude of sales tax compliance tasks. We offer:

- Accurate tax calculations

- Up-to-date tax rates across various jurisdictions

- Integration with numerous e-commerce, ERP, and accounting platforms

- Exemption certificate management solutions

By leveraging Sales Tax DataLINK, businesses can ensure their sales tax compliance is airtight, reducing the risk of costly penalties and audits. Furthermore, its automation capabilities free up valuable time and resources, allowing businesses to focus more on their core operations and less on the complexities of sales tax.

In a landscape where regulatory changes are constant and the cost of non-compliance is high, investing in a reliable and efficient tool like Sales Tax DataLINK is not just a smart move—it’s a strategic necessity. It’s time to embrace the technological solutions available and turn the daunting challenge of sales tax compliance into a manageable, automated process.